Calculate my income

Net income Total. So benefit estimates made by the Quick Calculator are rough.

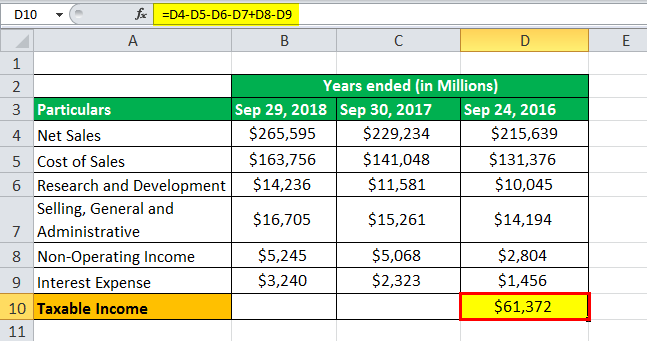

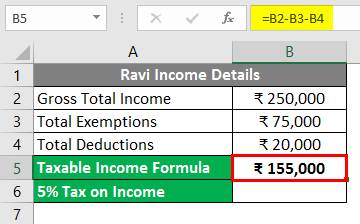

Taxable Income Formula Examples How To Calculate Taxable Income

First divide the weekly pay by 2.

. Gross income per month 10400 12. Every salaried individual needs to pay applicable tax. For example if a person made.

The latest budget information from April 2022 is used to. If youve already paid more than what you will owe in taxes youll likely receive a refund. Add up your monthly debt payments to determine your total monthly debt.

New jobs or other employment changes. To do that accurately you need to first start with your total monthly income. If the amount shown is.

How Your Paycheck Works. If you are early in your career or expect your income level to be higher in the future this kind of account could save you on taxes in the long run. 1200 2 600.

Adjust your estimate for any changes you expect. Consider things like these for all members of your household. Gross income per month 10 x 20 x 52 12.

Well calculate the difference on what you owe and what youve paid. An income tax calculator is an online tool that lets you calculate your income tax liability based on the income generated in a year. To find your net income you can use the formula below.

See your tax refund estimate. The net income formula can help you calculate your total income and other values more easily. Divide your total monthly debt payment by.

The Federal or IRS Taxes Are Listed. Determine your total monthly income before taxes. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity.

First you add up your. And is based on the tax brackets of 2021 and. Another popular rule suggests that an income of 70 to 80 of a workers pre-retirement income can maintain a retirees standard of living after retirement.

The Hawaii Tax Estimator Lets You Calculate Your State Taxes For the Tax Year. Planning for financial freedom requires number work. When filling out your application youll be shown the expected yearly income.

15 Tax Calculators 15 Tax Calculators. Gross income per month 86670. Next take the result from step 1 and move the decimal point two.

As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free. Write down the net expected income for coverage year or download and save the PDF. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

It is mainly intended for residents of the US. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. Calculate for Your Future.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Using the steps in the shortcut method to calculate your annual pay. Gross income per month 10 x 1040 12.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Net Pay Step By Step Example

How To Calculate Net Income Formula And Examples Bench Accounting

Taxable Income Formula Calculator Examples With Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Income Percentile Calculator For The United States

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

4 Ways To Calculate Annual Salary Wikihow

Annual Income Calculator

How To Calculate Gross Income Per Month

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Excel Formula Income Tax Bracket Calculation Exceljet

Net Worth Calculator Find Your Net Worth Nerdwallet

Calculate Income Tax In Excel How To Calculate Income Tax In Excel