5 401k match calculator

Reviews Trusted by Over 45000000. 100 per dollar on the first 3 of pay 050 per dollar on the next 2 of pay.

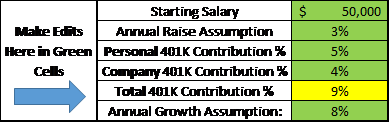

Customizable 401k Calculator And Retirement Analysis Template

Your employer match is 100 up to a maximum of 4.

. The benefit will be calculated as. This calculator assumes that your return is compounded annually and your deposits are made monthly. Please visit our 401K Calculator for more information about 401ks.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals. Talk to a Financial Advisor Today.

Discover Which Retirement Options Align with Your Financial Needs. In the following boxes youll need to enter. In this example you would enter 3.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. A 401 k can be one of your best tools for creating a secure retirement. In other words if you want to contribute 100month and.

Compare 2022s Best Gold IRAs from Top Providers. Reviews Trusted by Over 45000000. It provides you with two important advantages.

Many employees are not taking full advantage of their employers matching contributions. Your 401k plan account might be your best tool for creating a secure retirement. Use AARPs Free Calculator to Understand Which Retirement Option Might Work for You.

NerdWallets 401 k retirement calculator estimates what your 401 k balance will. You expect your annual before-tax rate of return on your 401 k to be 5. The annual elective deferral limit for a 401k plan in 2022 is 20500.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. If the employee wants to withhold more than 4 percent of gross wages the benefit will match 50 percent up to 4 percent of the gross wages. Pre-tax Contribution Limits 401k 403b and 457b plans.

Compare 2022s Best Gold IRAs from Top Providers. As you enter the information in each of these categories you will finds that our 401k Retirement Calculator updates the figures and gives you a final figure as you press Calculate. 050 per dollar on the first 6 of pay.

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit. You only pay taxes on contributions and earnings when the money is withdrawn. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000.

The annual rate of return for your 401 k account. Your current before-tax 401 k plan. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation.

Ad Develop Your Retirement Savings Strategy. A 401k match is an employers percentage match of a. The employer match helps you accelerate your retirement contributions.

Dont Wait To Get Started. Ad A 401k Can Be an Effective Retirement Tool. First all contributions and earnings to your 401 k are tax deferred.

In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of. If you dont have data ready. The actual rate of return is largely.

Ad TIAA Can Help You Create A Retirement Plan For Your Future. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Now a 401K contribution is determined by taking a percentage of your income rather than an amount of the income.

For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. IRA and Roth IRA. 23 5 401k match calculator Sunday September 4 2022 Edit.

The second most popular formula for employer matching.

401k Contribution Calculator Step By Step Guide With Examples

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Investing

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

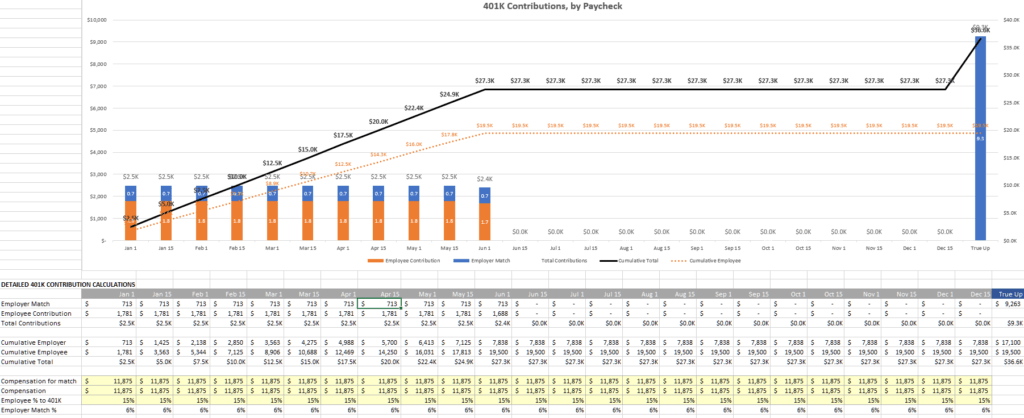

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

Ira Financial Group Introduces Additional Features To Solo 401 K Annual Contri Refinance Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

Here Is What You Could Expect In Retirement If You Use A 401k Tsp 403b 457 Or Ira As Your Retirement Investment Investing For Retirement Investing Stock Market

Doing The Math On Your 401 K Match Sep 29 2000

Investment Goals Investing Investing For Retirement Retirement Savings Plan

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

401k Employee Contribution Calculator Soothsawyer

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

401k Employee Contribution Calculator Soothsawyer

401k Contribution Calculator Step By Step Guide With Examples

401k Employee Contribution Calculator Soothsawyer

Classroom Objects Interactive And Downloadable Worksheet You Can Do The Exercises Online Or Downl School Supplies Classroom Language Learning English For Kids

Free 401k Calculator For Excel Calculate Your 401k Savings